To register for buy-side trading jobs email buyside@kandkgc.com

To register for buy-side trading jobs email buyside@kandkgc.com

To register for buy-side trading jobs email buyside@kandkgc.com

Established in 2009,

The Buy-side Trading Community (BTC)

is now an unsponsored global social initiative for traders worldwide.

Seize the opportunity, the buy-side trading desk in focus

Eric Heleine, Deputy head of trading desk, Groupama Asset Management

Our priority for the year 2017 naturally revolves around the implementation of MiFID II. The regulation is driving profound operational changes. It is obvious to me that the trading desk is at the heart of this transformation process which will have major impacts on the structure of the markets for equity and fixed income instruments, currencies, and commodities (“FICC”). The requirement to take “all sufficient steps” to obtain the best execution imposes us to review our trading practice.

Clients are already including questions about the firm’s execution capabilities in their Request For Proposals (“RFPs”) which clearly indicate the client’s interest in the firm’s best execution efforts. MiFID II will transform the market and the trading desk will be instrumental in delivering the intelligence on how to capture short term alpha opportunities in the new environment.

The subjects unbundling of research, selecting the tools for the tracking of research consumption (face-to-face and written research), setting up the research payment accounts (“RPA”) and regulatory reporting (RTS27 and 28) reduces the time given to the recurrent activities of the trading desk. But this profound transformation of our industry represents an opportunity to evolve and improve the trading capabilities of the buy side. More granularity in the data and an improvement of our TCA are assets to give to traders more responsibility and better tools.

A major share of my time as a deputy head of trading is currently prioritised around adapting to the upcoming regulatory changes; coordinating with people, reviewing processes, researching and implementing new technologies and trying to establish how we will interact with counterparties and venues. This means that a major part of the day to day trading activities need to be delegated to the trading staff.

The trading desk and processes

The obligation of best execution requires us to review our trading process. For example, on equities we are working on a better segmentation of our flows by flagging low and high touch. The objective is to group together flow that is similar in characteristics. The process of grouping is based on different characteristics like liquidity, spread and volatility. The fragmentation post MiFID I has added complexity for the trader to understand the behaviour of brokers’ Smart Order Router (“SOR”), the nuances between various strategies but also the implementation differences across brokers. One simple and effective solution for the low touch flow is to create an automated execution wheel to randomize the flow between different brokers after that trader has defined the executions objectives.

The goal is to allow the trader to focus on high-touch orders where the market impact and short alpha generation is crucial.

Core areas for the high touch trader is the sensitive small- and mid-cap market and block trading. We expect the price for liquidity in this market and natural block liquidity to increase in the future.

In fixed income, we are challenged by the need to identify additional characteristics to make the proper segmentation of orders. We need to separate order flow processes based on liquidity, time sensitivity of the execution and take into account the additional complexity of number of issuances.

We expect to go for a hybrid RPA model, at least to start with. It seems too challenging in the short term to use incremental fees for FICC so this will force us to pay from our own P&L. If we see evidence that clients understand the additional RPA charges we will review this position. For equities we have chosen to progress with a RPA model using a commission sharing agreement (“CSA”) approach. It is easier said than done as it is not an easy task to resolve the post trade challenges, SWIFT message depositary and IT impact. Research utilisation needs to be allocated by strategy. We already have a history of using CSA and we know it is a robust model that works globally.

Technology and automation

The best analysis of our trading data makes it possible to offer the trader tools and analytics allowing a better interaction with our brokers as well as more granular discussions on outlier management. It’s therefore crucial to upgrade our information system and trading tools to better collect, store and analyses the data.

• We decided 1 year ago to implement a new SimCorp platform, which is already partially live, to improve the global workflow for the PMs, trading desk and back office.

• To support the new way we organise the trading desk for equity trading, we decided to change to ITG Triton with the rationale that we needed to automate low touch and advance with a better way to access Large In Scale (“LIS”) liquidity and future proof our capabilities to utilise all new types of protocols for block trading. For low touch flows, the ITG Triton “algo wheel” feature, in combination with improved TCA analysis, makes it easier for the trader to simply select execution based on a simple strategy and dynamic volume. We generally focus on the real value mid-caps and I believe that the growing challenge to access the mid-cap market partially can be resolved with technology.

• We have already invested in connecting electronic trading tools for fixed income such as MarketAxess, Liquidnet, Tradeweb, TSoxx etc. and there is a challenge to find in the future a robust EMS for this asset class. It seems like the fixed income EMS suppliers are still in an early developing phase and we may have to just wait a little to find a mature future proofed version that we will be ready to invest in. It is important for us to find an EMS with dark capabilities to minimise market impact. We are also monitoring the evolution of the market trading new additional types of protocols in addition to request for quote (“RFQ”).

• For foreign exchange trading we have recently added FXAll in addition to Bloomberg FXGO.

• The choice of the right TCA solution provider is crucial to support the workflow within our team and to manager the relationship with our counterparties. The broker’s added value need to be quantified and we need to understand their order routing methodology and toxicity levels by broker. The results are summarised in a score card by broker with; venue reversion, information leakage, spread capture, number of LIS trades, split of high and low touch flow.

• For real time monitoring we use a combination of analytics tools in the EMS, granular alert systems and simulation tools that can visualise the impact, split by agency and risk etc.

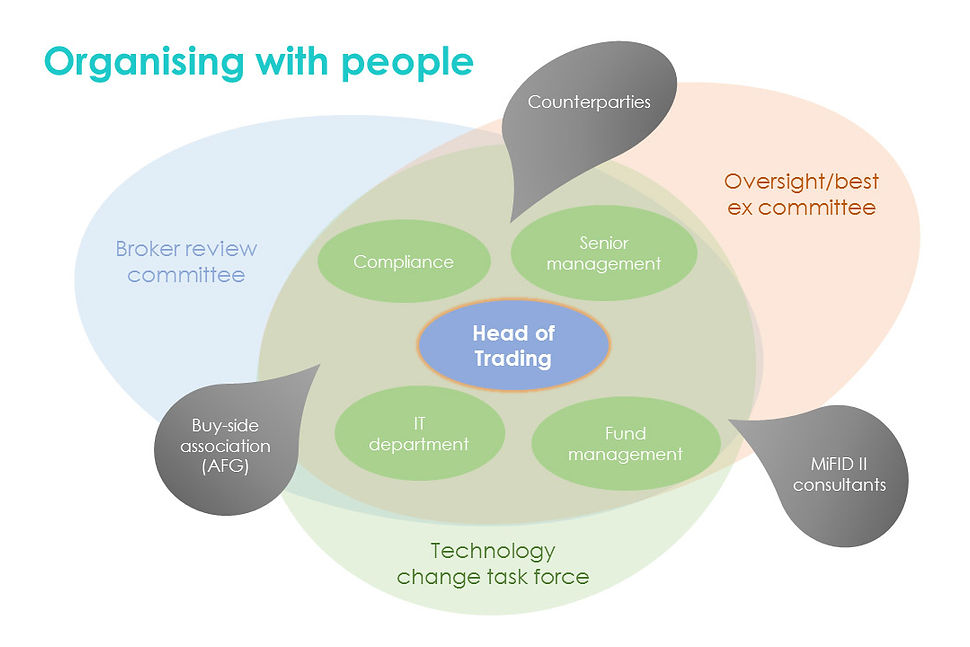

Organising with people

With only 6 months left to meet MIFID II requirements, all teams are working in the same direction to achieve this goal.

Internally we need to interact with the compliance team, portfolio management, senior management, IT department and the broker review committee. As a part of this interaction we constantly need to establish how any changes will impact the trading desk.

• We need to work with our portfolio managers to get their agreement or convince them that our processes and changes are in the best interest of our clients and commercial objectives.

• The compliance team is helpful in the process of verifying that our plans are adhering to the new and changing requirements.

• All plans need senior management authorisation as it will have a global impact on Groupama Asset Management.

• Our broker review committee is instrumental as a lot of my efforts is focused around how I can maximise the potential with our partnerships.

• As technology is core in the automation and workflow, I need to involve the IT department and ad hoc organise special task forces to, for example understand how our technology suppliers are adapting to regulatory change and will support us in the transformation.

Looking at the current workload, I can foresee that there may be a further need to organise an additional oversight committee responsible for the increasing number of policies and processes in the unbundled organisation.

I also work actively with our broker counterparties, MiFID II consultants as well as the buy-side peer association Association Française de la Gestion financière (“AFG”) to make sure we leverage as much external knowledge as possible.

Partnerships and market outlook

It is important for us to maintain a good broker list based on objective quantitative data where we have granular understanding of flow. We want to work with brokers that invest in best-of-breed in-house trading system for low touch and we need brokers with many liquidity specialists. The brokers must make strategic business decisions in the areas they want to lead, be it order processing, flow management or being a flow specialist. It is hard to cover all areas. I believe that brokers that neither demonstrate best in class in-house technology nor offer liquidity specialists will be challenged by losing buy-side relationships in the future. Broker specialisation will not disappear as it is very important with good knowledge. The spread between order-flow brokers and specialists are likely to widen and all brokers cannot be specialists.

While the trend is to reduce the number of brokers is mainly true for low-touch flow algorithmic trading, the opposite challenge applies to the small-/mid cap market where we must work with whoever is the liquidity specialist.

Post 3rd of January 2018 with the implementation of MiFID II, we need to make hard decisions if we want to interact with systematic internalisers (“SIs”) and all new venues. We need to understand how the venues meet our chosen benchmarks and the level of toxicity. We prefer to post passive orders in less toxic venues and to be able to use conditional order types such as minimum quantity to trade. We need to configurate our order routers to minimise market impact. While want to be interactive with SIs, the value of the order book can be changing. If the SI can only fulfil a small part of the order, it may signal the market too much. We have many discussions with our brokers about the SI regime and need to understand their level of interaction with high frequency traders (“HFT”) and if we can trade truly anonymous or not. The broker will be challenged to deliver real liquidity and the large trades must be truly dark. SIs will likely need to reveal what type of flows they interact with.

We are also making sure that we have all the tools ready to execute and interact with alternative venues such as BATS LIS, Liquidnet, and Plato as an alternative pool for real liquidity.